U.S. firms aren’t rising in London. They’ve risen.

BY:

Caterina Conti

Media Operations

PROJECT COUNSEL MEDIA

25 June 2020 (Paris, France) – U.S. firms aren’t rising in London. They’ve risen. The astonishing reality in 2020 is that just seven UK-headquartered firms generate more revenue in London that their biggest US counterparts – an indication of the US firms’ growing appetite for domestic mandates. Most of those U.S. competitors are also more profitable.

When US firms started ramping up in London well over a decade ago their focus was still largely on servicing domestically-based clients with UK mandates. It didn’t take long for the likes of Kirkland and Latham to capture the attention of UK plc, helped by their willingness to splash out on best-in-business lawyers. We’re starting to see how this dollar-fuelled growth of US firms in London is beginning to impact the domestic beasts.

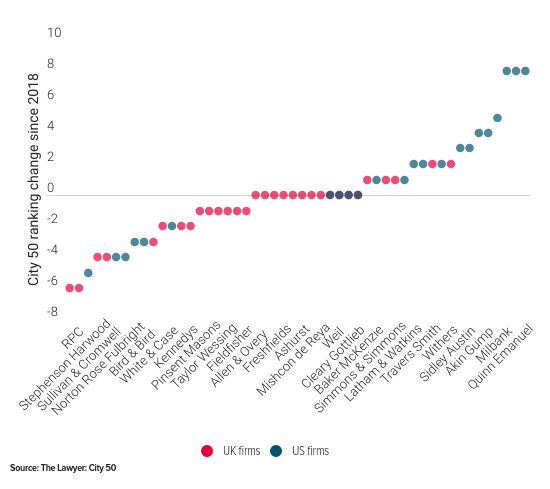

We’ve jumped back into The Lawyer’s City 50 ranking which we wrote about last week which does an in-depth analysis of U.S. and UK firms by London revenue, and the domestic players are beginning to lag in terms of growth. Movement across the City 50 rankings in the three reports between 2018 to 2020, shows the net ranking increase for US firms was plus 33 while the total for UK firms was minus 31 (these numbers don’t net to zero because of firms moving in and out of the rankings).

What these rankings illustrate is that not only are US firms leading the way when it comes to attracting global mandates in the City, they’re also achieving organic growth in London by stealing a march on the mid-tier. For while the UK’s five largest firms (Linklaters, Allen & Overy, Clifford Chance, Freshfields and Slaughter and May) have maintained a leading position in the City 50 thanks to decades of investment into London, the US firms are putting the squeeze on those lower down the rankings.

Norton Rose Fulbright, for instance, has slipped three places in the City 50 since 2018 from 10 to 13 despite a decade of investment. Charles Russell Speechlys and Stephenson Harwood have both fallen four places to 40 and 28 respectively, while Bird & Bird is down three to 34. RPC and Addleshaw Goddard have been pushed down even further, dropping six places from 38 to 44 for RPC and 32 to 38 for Addleshaws. In fact, just two firms have moved up the City 50 by more than one place and both by two places – Travers Smith to 24 and Withers to 48.

Compare that with the US firms. The biggest U.S. movers in the City are Milbank (40 to 32), Quinn Emanuel (44 to 36), and Debevoise (49 to 41) – all firms jumped by eight spaces. Simpson Thacher, which counts the likes of Aston Martin Lagonda along with juggernaut PE behemoth Blackstone as clients, has climbed into the 25 position from 30 in just two years ago.

THE BIG TAKE-AWAY? The last decade has seen the much-needed evolution of the UK legal business model. But mounting competition from U.S. firms and, increasingly, European firms, shows what UK plc desperately wants from the UK legal market is more radical and entrepreneurial thinking.