With their deep pockets, will U.S. firms start poaching the best of the young British talent?

BY:

Caterina Conti

Media Operations

PROJECT COUNSEL MEDIA

26 June 2020 (Paris, France) – Allen & Overy, Clifford Chance and Osborne Clarke turned heads this week by announcing salary cuts of 10 and 5.5 per cent respectively for newly-qualified (NQ) solicitors. However, a glance at the magic circle’s NQ data since 2007 shows that this is a predictable precaution and like most law firms in the City, they are expecting a medium-term fall in profits.

NOTE: Over the last week, we have been examining surveys recently run by “The Lawyer”. The following are a few snippets from a survey done by “The Lawyer” and “Chamber Students” (the latter being an organisation that independently reviews over 160 law firms and barristers’ chambers across the UK)

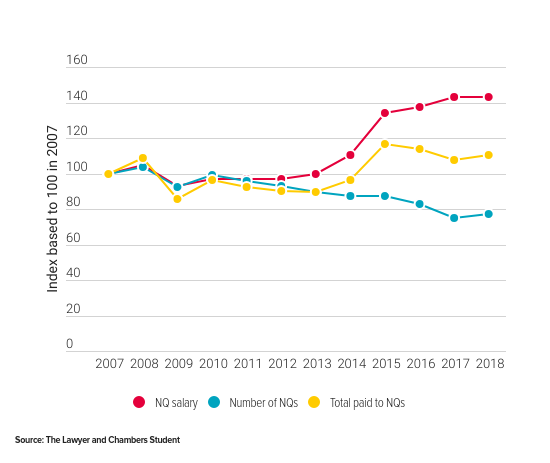

The magic circle has a history of reducing NQ salaries when times get tough. In 2008 the average NQ salary in the magic circle was £66,000 and it then dropped by 11.4 per cent to £59,000 in 2009. NQ salaries didn’t rise above their pre-financial crisis levels until 2013. Alongside this salary cut, they also decreased their number of NQs in 2009 by 11 per cent from the previous year. This combined fall in wages and headcount meant that their NQ bill was 23 per cent lower. At a time of depressed revenues, this was sensible practice.

Between 2013 and 2018, driven by a pay war with their American rivals, magic circle NQ salaries rose by 43 per cent from £63,500 to £91,000. However, to keep the wage bill at a manageable level they have been taking on fewer NQs every year since 2008. From 2013 to 2018, the magic circle only took on 1,964 NQs, a 14 per cent drop on the preceding six years.

The 23 per cent increase in net profits since 2013 suggests that the model of paying fewer associates more to work harder has been successful and The Lawyer has noted firms have deleveraged since the previous crisis. What it does mean though, is that reducing headcount is no longer a viable strategy for cutting costs. When firms are leaner, any significant reductions will have to come out of the wage bill so we can probably expect a significant period of decreasing or stagnant pay at the UK’s biggest firms.

THE BIG TAKE-AWAY? Baker McKenzie, Kirkland & Ellis, Latham & Watkins, White & Case and several other U.S. firms that operate in the UK will be looking at this situation with interest. For the time being, none have announced NQ salary cuts. But as the survey notes:

“With their deep pockets that outmatch UK firms, it means that the coming years could be a great time to poach the best of the young British talent. The pay war is over for now and it seems the US may have won”.